There’s no doubt about it: We’re in a sharp housing market downturn.

Across the country, mortgage brokers and builders are scrambling as millions of potential buyers sit on the sidelines after last year’s historic mortgage rate shock. The numbers aren’t pretty: On a year-over-year basis, mortgage purchase applications are down 36.4% and existing home sales have fallen 35.4%.

While home transactions went into free fall in the second half of 2022, home prices have felt less of an impact. Through October, seasonally adjusted U.S. home prices were down just 2.4%, as measured by the Case-Shiller National Home Price Index. On one hand, that marks the second biggest home price correction of the post-WWII era. On the other hand, it’s mild compared to the 26% peak-to-trough U.S. home price crash from 2007 to 2012.

In the future, Moody’s Analytics chief economist Mark Zandi expects the story to begin to change: The free fall in home sales will soon bottom out, while the home price correction will carry on.

“Housing demand (home sales) is close to a trough, housing supply (housing starts and completions) has yet to hit bottom, and house prices have a way to go before reaching their nadir,” Zandi tells Fortune.

By the time U.S. home prices bottom out, Zandi expects them to be 10% below the 2022 peak. He isn’t the only economist who thinks home prices will continue to fall: Among the 24 major housing forecasters tracked by Fortune, 17 predict that U.S. home prices will decline further in 2023. (Another seven firms think U.S. home prices will remain flat or rise by a low single-digit amount in 2023.)

“The housing market downturn, triggered by rapid increases in mortgage borrowing costs, continues to cause us significant concern. Prices have risen hugely over the past couple of years as demand vastly outstripped limited supply of homes, but this process is going into sharp reverse,” writes James Knightley, chief international economist at ING. His firm expects around a 10% peak-to-trough decline in U.S. home prices.

Keep in mind that when a group like ING or Moody’s says U.S. home prices, they’re talking about a national aggregate. Whatever comes next will likely vary significantly by market. After all, there’s a reason industry types like to say that “real estate is local.”

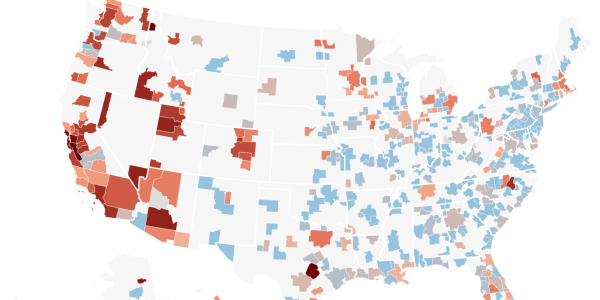

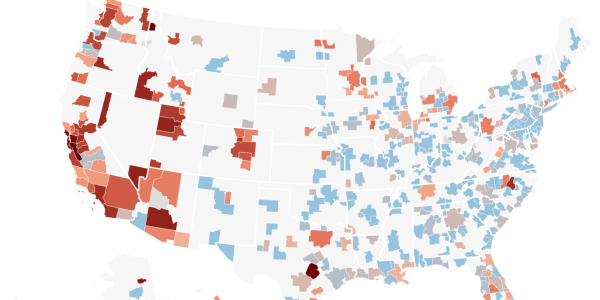

To better understand the regional home price story, Fortune reviewed the Zillow Home Value Index (ZHVI) for November 2022.*

Through November, home values in 254 of the country's 400 biggest housing markets were below their 2022 peak. In those markets, the average decline was 2.1%.

"Home values slipped 0.2% in November, resuming a slow decline that began this summer. Once again, the proximate cause could be traced to high mortgage rates," write Zillow researchers. "While national prices only inched down, they slumped more dramatically in many formerly-hot housing markets."

The markets hit the hardest by the correction fall into one of two groups.

The first is boomtowns, often second-home markets or up-and-coming cities, where remote workers moved during the pandemic and pushed local home prices beyond what local incomes could support. That "froth" might explain why home prices are falling more swiftly in boomtown markets like Coeur d'Alene, Idaho (where home values are down 10.8% from the peak); Austin (down 10.4%); Phoenix (down 8.1%); Las Vegas (down 8%); Salt Lake City (down 7.9%); and Reno (down 7.6%).

The second group comprises high-cost markets along the West Coast, including places like San Jose (where home values are down 10.6% from the peak); San Francisco (down 9.5%); Santa Cruz, Calif. (down 8.4%); and Seattle (down 5.8%). Historically speaking, those high-end markets are vulnerable whenever the stock market slips into bear territory or mortgage rates spike. Of course, both red flags occurred in 2022.

While home prices in 254 major markets are below their 2022 peaks, another 146 major markets remain at their 2022 peaks. The ongoing mortgage rate shock has yet to cause home values, as measured by Zillow, to fall in markets like Indianapolis, Miami, and Philadelphia.

So therefore the coast is clear in markets like Miami and Philadelphia, right? Not so fast, says Moody's.

While the home price correction has yet to impact tight-inventory markets like Miami and Philadelphia, it still could this year. Moody's expects home prices to fall further this year in every major regional housing market. In cities like Miami and Philadelphia, Moody's expects that peak-to-trough decline to hit 16.9% and 5.3%, respectively. (Here is Moody's outlook for the nation's 322 largest markets.)

While the ongoing housing downturn has translated into the U.S. housing market flipping from inflation mode to deflation mode, it has only barely touched the gains accrued during the Pandemic Housing Boom. As of October 2022, U.S. home prices were still 38.1% above March 2020 levels.

Even in the housing markets hit hardest by the correction, including San Francisco (down 9.5% from its 2022 peak) and Austin (down 10.4% from its 2022 peak), prices remain well above pre-pandemic levels. Indeed, as of October, home values in San Francisco were 16.9% above pre-pandemic levels while those in Austin were up 57.1%.

*Note: The Zillow Home Value Index (ZHVI) is a measurement of the typical home value in a given region. According to Zillow, the index "reflects the typical value for homes in the 35th to 65th percentile range." Fortune pulled ZHVI's "raw version," which is not seasonally adjusted.

Want to stay updated on the housing correction? Follow me on Twitter at @NewsLambert.