In the U.S., the beauty market continues to expand, though at a slower pace. According to Circana data, the US prestige beauty market grew by 2% to USD 16 billion, while mass beauty sales increased 4% to USD 34.6 billion in the first half of 2025. How the Trump administration’s new tariffs will affect the market might become more evident later in the year.

The mass and prestige beauty markets might finally be converging in the U.S.! Indeed, sales of premium-priced brands in mass retail and of value-priced prestige brands outperformed their counterparts during the first half of the year.

“The beauty industry’s latest results are indicative of a consumer who is focused on efficacy and elevated value,” commented Larissa Jensen, Global Beauty Industry Advisor at Circana. “Only 14% of US beauty buyers believe that higher prices indicate a better-quality product.”

In the first half of 2025, the U.S. prestige beauty market grew by 2% to USD 16 billion, while sales at mass merchants increased 4% to USD 34.6 billion, according to Circana.

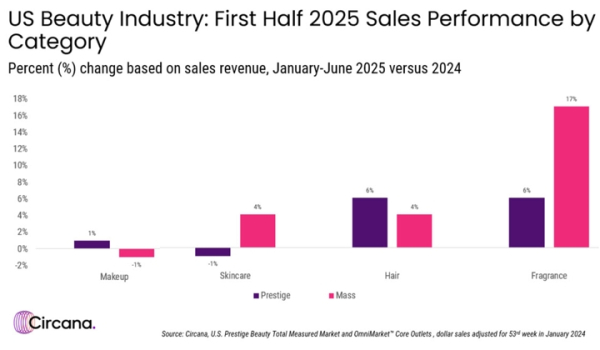

Prestige fragrance sales increased by 6% to USD 3.9 billion and grew on all metrics including units sold and average selling price. Notably, sales accelerated in the second quarter, compared to the first quarter, with new fragrance brand launches playing a significant role in this growth. These new products represented nearly one-third of total fragrance dollar gains. High concentrations, particularly eau de parfums and parfums, continue to drive the market growth..

Simultaneously, consumers gravitated towards more affordable options, with mini/travel size juices growing by 15% in units sold – nearly four-times the rate of other sizes. Fragrance was the fastest-growing category in the mass market, up 17% based on dollar sales, and driven by women’s fragrances.

As far as hair is concerned, sales in the prestige channel posted a 6% increase during the first half of the year to reach USD 2.3 billion. According to Circana, all prestige hair segments reported growth, ranging from a single digit increase for shampoos and conditioners to a double-digit lift in styling products. Scalp care also remained strong in the first half of the year, up 19%. In contrast, the overall hair category had a softer performance in the mass channel, with dollar sales up 4% and units flat.

On the makeup side, prestige retail sales posted USD 5.2 billion in first half sales, reflecting a modest growth of 1% while units sold remained flat. In contrast, makeup sold in mass outlets declined in the low single-digits based on both dollars and units.

Lip products emerged as the top contributor in prestige makeup, despite a slowdown to 3% growth, and was the only growth area for cosmetics sales in the mass channel. The prestige eye makeup segment showed improved performance, reversing last year’s decline, thanks in large part to growth in mascara sales. Face makeup, the largest segment in prestige cosmetics, remained flat.

From January through June, skincare sold in the mass market outperformed prestige. Mass skincare sales increased by 4% based on dollars and grew in terms of units sold. In contrast, prestige skincare dollar sales declined 1% to USD 4.6 billion, although units sold did increase.

According to Circana, the decline in prestige skincare is primarily attributed to facial skincare sales declines in brick-and-mortar stores. The prestige body segment continued to thrive, with body creams, cleansers, and hand soaps the most significant contributors to growth.