Speaking to clients in spring 2022, researchers at John Burns Real Estate Consulting made their case for why the red-hot U.S. housing market would soon plunge into a correction in which prices would fall by double-digits in many overheated markets. The call was bold, considering at the time Zillow economists were predicting that U.S. home values would skyrocket another 17.8% between February 2022 and February 2023.

It turns out JBREC researchers weren’t just right, they were spot on.

Not long after the Fed began raising interest rates, spiked mortgage rates caused the U.S. housing market to slip into what Fed Chair Jerome Powell calls a “difficult [housing] correction.” That abrupt slowdown caused home transaction volumes to crash across the country in the second half of 2022. Additionally, U.S. home prices as measured by the seasonally adjusted Case-Shiller National Home Price Index, which prior to 2022 hadn’t fallen on a monthly basis since 2012, declined 2.5% between June and November.

On one hand, a 2.5% drop in U.S. home prices could seem insignificant considering U.S. home prices roared 41% during the Pandemic Housing Boom. On the other hand, the fact that researchers at firms like Bank of America and KPMG think home price declines will continue through 2023, means the correction should certainly be watched.

To get a better understanding of what’s happening regionally, Fortune reached out to researchers at John Burns Real Estate Consulting. They provided us with access to their proprietary Burns Home Value Index (BHVI).

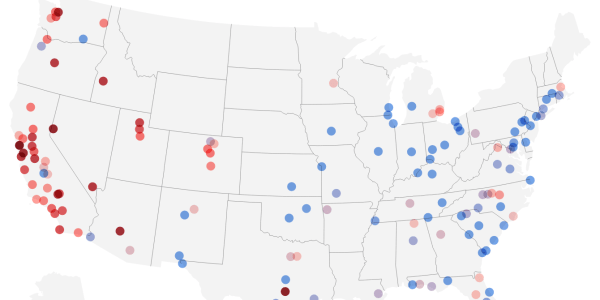

While national home prices deflated a bit in the second half of 2022, the story varies significantly by market. You could even call it a bifurcated home price correction: Some regional markets have fallen sharply, while others have barely moved.

Among the 150 major housing markets tracked by Burns Home Value Index, 100 markets ended 2022 with local home prices below their 2022 peak. While 50 markets, including places like Milwaukee and Miami, ended 2022 with local home prices remaining at all-time highs.

Among the down markets, 24 regional housing markets ended 2022 with home prices down at least 5% from their respective 2022 peak price.

The vast majority of the markets with sharp price drops, including places like Seattle (-8.7%) and Santa Cruz (-8.2%), are on the West Coast. One reason is affordability: Many West Coast housing markets were already strained affordability wise, and spiked mortgage rates simply pushed those markets over the edge.

There’s another reason: A higher share of homes in overheated West Coast housing markets are owned by iBuyers and homebuilders. Unlike primary homeowners, investors and builders are more likely to slash prices if sales stop.

The best example of the bifurcated housing correction might be the contrast between Chicago and San Francisco.

During the Pandemic Housing Boom, Chicago and San Francisco had similar paths. Both markets saw a surge of outmigration as remote work took hold. Both markets also still had a huge run-up in home prices as demand for “space” soared during the lockdowns.

However, the trajectory of home prices in Chicago (down 0.1%) and San Francisco (down 10.5%) diverged just as mortgage rates crossed 5% in 2022. It all boils down to affordability: Homebuyers in San Francisco were already near their financial limits, while Chicago buyers still had a little more breathing room to absorb the rate shock.

The sharp home price corrections aren’t just occurring in high-cost West Coast markets. It’s also happening in “bubbly” housing markets, including places like Austin (-9.5% from its 2022 peak), Boise (-8.1%), Las Vegas (-8.3%), and Phoenix (-8.9%).

During the pandemic boom, home prices in these so-called “Zoomtowns” soared far beyond what underlying fundamentals (i.e. local incomes) would historically support. Once remote migration slowed and mortgage rates spiked, those “bubbly” or “frothy” boomtowns slipped into sharp corrections.

Where does the home price correction go next? While real estate researchers remain divided, they do agree that the trajectory of mortgage rates over the coming year is the biggest uncertainty. If mortgage rates stay elevated, it only increases the odds that national home prices will fall further.

“Home prices are usually the last indicator to find a floor in a housing downturn, and we still think there’s a good amount of time ahead of us until that happens as long as [mortgage] rates stay 6% plus,” Rick Palacios Jr., director of research at John Burns Real Estate Consulting, tells Fortune. The new home side, he says, will continue getting hit the hardest. “The price cuts since the 2022 peak for home builders are typically much more significant than resale, especially if you consider the costs incurred by builders paying to buy-down the rate for homebuyers.”

Looking for more housing data? Follow me on Twitter at @NewsLambert.