As the luxury and ultraluxury beauty market has the potential to double by 2027, from around USD 20 billion today to around USD 40 billion, according to McKinsey, the beauty and fragrance giant does not want to overlook this segment and announced several initiatives to premiumize its offer.

Considering the excellent results of its Prestige division, Coty intends to adapt its offer to structural changes in the market, especially with regard to perfumery where more and more consumers opt for longer-lasting and more premium products.

“Against this backdrop, we continue to grow the fragrance category and premiumize our business through our portfolio of icons and leading launches, such as Burberry Hero and Her, Gucci Flora Gorgeous Jasmine and Gorgeous Gardenia, Boss Bottled Parfum and Chloe Atelier des Fleurs,” said Sue Y. Nabi, Coty’s CEO, commenting on the company’s latest operating results.

A new line of luxury perfumes

To go further in this process, Coty announced in May the launch in 2024 of Infiniment Coty Paris, a new collection of high-end fragrances, that will be to this category what the group’s ultra-premium brand Orveda is to skincare. The project was introduced as the “most ambitious and most premium fragrance project to date,” for the company.

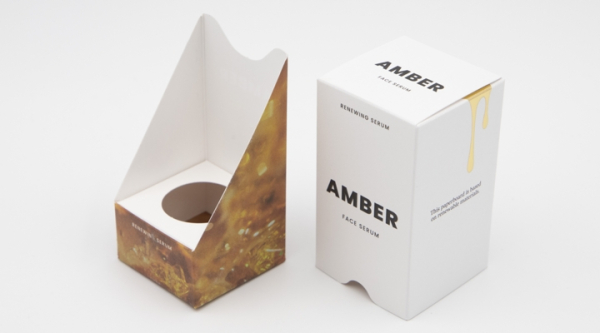

The collection, for which there are patent pending for both the formulation and the packaging (a first according to Coty), will ultimately include a range of fourteen scents.

“Infiniment Coty Paris is a creation that marks a natural progression for the company, fusing beauty, science, and art,” said Sue Y. Nabi, explaining that much more is set to come in the next months.

Cater to a more luxury-oriented market

With brands such as Gucci, Chloé, Burberry and Miu-Miu in its portfolio, Coty has all the means that are required to meet the demand of consumers who are trading up and increasing their spending in more premium products, especially in fragrance and makeup.

In the third quarter of its 2022-2023 financial year, Coty published revenues growing up 9%, despite its exit from Russia. Over the period, its Prestige division grew by 10% and generated an operating profit of 102.4 million dollars, against 83.8 million dollars the previous year. It now represents 62% of the group’s activity.

In particular, the company intends to capitalize on the momentum in its established businesses, coupled with strong savings, to fuel its skincare business the next key pillar in its strategy, again, targeting the top of the segment.

“While we are in the very initial stages of igniting our focus skincare brands, I am encouraged by the positive initial signals we are tracking, whether it is leading social buzz and product reviews for Lancaster Ligne Princière, or step-changes in philosophy’s sales fuelled by its new brand equity and newly launched serum, dose of wisdom,” noted Sue Y. Nabi.

The very recent launch of Orveda’s OmniPotent Concentrate responds to the same logic of exploring the expectations of the upper segment of the market.

At the beginning of May, the group, already listed on the New York Stock Exchange, announced it was considering a second listing in Paris, with the aim of strengthening its presence in Europe and attracting new investors.