History tells us that the Federal Reserve’s inflation-fighting playbook starts with the U.S. housing market. It goes like this. The central bank begins by applying upward pressure on mortgage rates. Soon afterwards, home sales fall and homebuilders begin to cut back. That causes demand for both commodities (like lumber and concrete) and durable goods (like refrigerators and doors) to fall. Those economic contractions then slowly spread throughout the rest of the economy and, in theory, help to rein in runaway inflation.

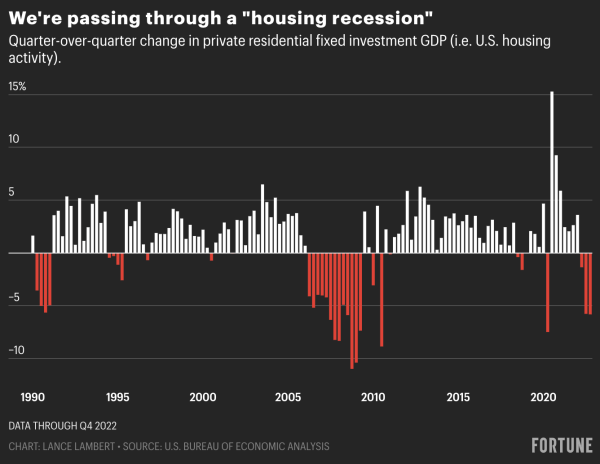

That’s exactly what we saw last year: The Fed started jacking up interest rates, mortgage rates spiked, and the U.S. housing market slipped into an old school housing downturn—with its hardest punch being packed out West.

Fast-forward to spring 2023, and the U.S. housing market appears to be stabilizing relative to its free-fall in the second half of 2022. However, the uptick in new home sales isn’t enough to stop the economic headwinds created by the housing slump. At least that’s how economists at Vanguard see it.

“Since World War II, declines of greater than 10% in the annualized rate of investment in housing construction and improvements (or “residential fixed investment”) have coincided with recession on all but two, wartime occasions, when defense spending propped up the economy. In the last three quarters of 2022, declines in such investment hovered around –20%,” wrote Vanguard economists in a recent report.

Heading forward, Vanguard expects the housing market downturn to help push the U.S. economy into a mild—not deep—recession.

“The housing downturn is part of the reason why we view a mild U.S. recession in 2023 as most likely,” wrote Vanguard economists.

By the time national home prices bottom later this year, Vanguard expects U.S. home prices as measured by the Case-Shiller National Home Price Index to drop 5% on a year-over-year basis. In order for that to happen, the national housing market would need to slip back into correction-mode in the seasonally weaker summer and fall months.

But don’t call this 2008—a bust that saw U.S. home prices fall 26% peak-to-trough.

In fact, Vanguard thinks that after the housing market helps to push the U.S. into a recession, the housing recovery will then help to drive the overall economic recovery.

“As affordability normalizes, however, housing should act as an economic stabilizer,” wrote economists at Vanguard.

What will eventually pull the U.S. housing market—which has seen limited sales this spring as mortgage rates sidelined many would-be buyers and sellers—out of recession?

“Our researchers believe U.S. housing activity will be driven in the next couple years by: 1) the structural undersupply of homes that’s prevailed since the 2008 global financial crisis; 2) robust demographic trends and favorable sentiment toward homeownership; and 3) strong borrower fundamentals and high equity cushions,” wrote economist at Vanguard.

Want to stay updated on the U.S. housing market? Follow me on Twitter at @NewsLambert.