Sales of make-up products in South Korea are expected to expand at a 5.5% CAGR [1] through 2026, according to GlobalData. As consumers increasingly return to their outdoor activities, product innovation and the rise of online sales are expected to drive the market growth.

The South Korean make-up market is set to expand at a healthy pace in the coming years, spurred by increasing public outdoor mobility, high product innovation, and rising online sales. Moreover, a strong celebrity culture is contributing to the expansion of the consumer base, and encouraging South Korean men to embrace makeup in their beauty routines. Against this backdrop, the South Korean make-up market is projected to rise to KRW2,827.8 million (USD 2.5 billion) by 2026, registering a compound annual growth rate (CAGR) of 5.5% over 2021-2026, says GlobalData.

According to a recent report [2] by the a data and analytics company, the face make-up category will register the fastest growth over the forecast period, followed by the lip make-up category.

“Spurred by Korean pop music, movie, and TV celebrity endorsements, and the availability of innovative Korean Beauty (K-Beauty) products, South Korean men are spending more on make-up products. With the authorities easing the COVID-19 restrictions in 2022, consumers began leaving their homes more often for work, studies, leisure, socializing, shopping, and other activities, thereby giving rise to more occasions for applying make-up. Moreover, the increased penetration of online beauty retailers bolstered sales of cosmetics,” said Suneera Joseph, Consumer Analyst at GlobalData, in a statement.

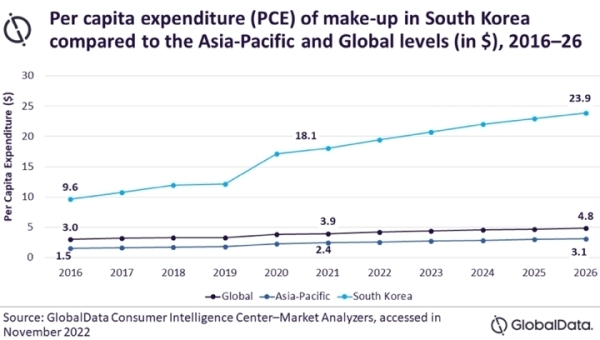

The per capita expenditure (PCE) on make-up in South Korea increased from USD 9.6 in 2016 to USD 18.1 in 2021, surpassing the regional average of USD 2.4, and the global average of USD 3.9. GlobalData forecasts South Korea’s PCE on make-up to surge to USD 23.9 by 2026.

Amorepacific Corporation, LG Corp, and The Estée Lauder Companies were the top three companies in the South Korean make-up market in value terms in 2021, while The Face Shop and Sulwhasoo were the leading brands. E-retail was the leading distribution channel, followed by health & beauty stores, and direct sellers.

“Going forward, the rising consumer interest in clean beauty will bolster demand for make-up products containing natural and organic ingredients that are perceived to be gentle and more effective than harsh chemicals. As a result, domestic and multinational manufacturers are expected to roll out innovative products with natural and sustainable ingredients with the effectiveness of regular chemical formulations. However, the emergence of new COVID-19 variants and rising inflation can derail the recovery of the South Korean make-up market in the immediate future,” concludes Suneera Joseph.