At the height of the Pandemic Housing Boom last spring, Zillow economists remained bullish and predicted that national home prices would skyrocket another 17.8% between February 2022 and February 2023. However, as mortgage rates crossed over 6% and the housing market slipped into a slump, Zillow started slashing that aggressive home price forecast. By December, Zillow was predicting that national home prices would fall 1.1% between November 2022 and November 2023. Fast-forward to May, and Zillow is slowly drifting back into the housing bull camp as the U.S. housing market stabilizes amid the higher mortgage rate environment, and home prices in most markets are starting to rise again.

Heading forward, Zillow’s forecast model expects U.S. home prices, as measured by the Zillow Home Value Index (ZHVI), to jump 4.8% between April 2023 and April 2024. For perspective, national home prices as tracked by ZHVI have averaged an annual appreciation rate of 5.08% since 2001.

“A normal springtime seller’s [spring] season represents a remarkable turnaround from the second half of 2022, which was much cooler than normal as buyers retreated in the face of affordability challenges. Those challenges are still acute,” wrote Jeff Tucker, an economist at Zillow in a report published earlier this month. “Despite being 2.2% lower than its peak last July…[U.S. home prices are] still 1.5% higher than one year ago and 38% higher than in April 2020, an 11% average annual growth rate over the past three years.”

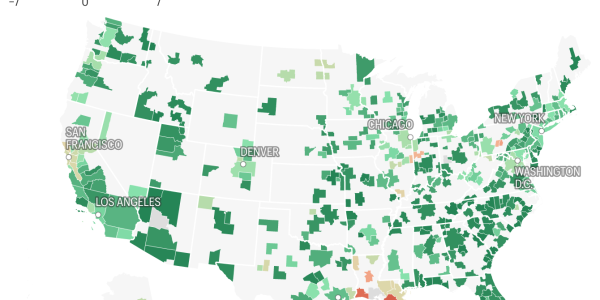

Among the nation’s 400 largest housing markets (see map above), Zillow expects only 10 markets, including Houma, La. (-5%) and Santa Rosa, Calif. (-0.1%), to see a home price decline between April 2023 and April 2024.

During that same 12-month span, Zillow expects 390 regional housing markets to see a home price increase. Of those, Zillow thinks 150 markets will rise by less than 4%, another 203 by 4% to 6.99%, and 37 by at least 7.00% (see chart below).

Why is Zillow bullish on these 37 housing markets?

There isn’t one unifying factor—and these 37 housing markets are located all over the country. They’re spread over the West (like Show Low, Ariz.), South (like Sevierville, Tenn.), Midwest (like Columbia, Mo.), and Northeast (like Augusta, Maine).

The reason that Zillow economists think home values can continue rising, despite affordability remaining pressurized, boils down to the fact that supply remains tight and demographics remain favorable.

“All told, about half a million fewer new listings have entered the market in the first four months of 2023 than in 2019’s first four months—a deficit of 30%. Many would-be sellers don’t want to let go of their homes, on which they’re paying about 3% in mortgage interest in many cases, when they’d have to pay 6% or more on a new 30-year loan,” wrote Zillow’s Tucker in a recent report.

While firms like CoreLogic and Zillow expect national home prices to rise over the coming year, firms like Fannie Mae and Moody’s Analytics still expect a mild correction this year.

Want to stay updated on the housing market? Follow me on Twitter at @NewsLambert.